When using QuickBooks Connector, you'll need to map your taxes as part of the standard configuration process. Below are a few common tax configuration scenarios explained:

eCommerce and QuickBooks Online integrations

For eCommerce and QuickBooks Online integrations, for each tax created/defined in your e-commerce store, you must select its corresponding tax code in your QuickBooks Online.

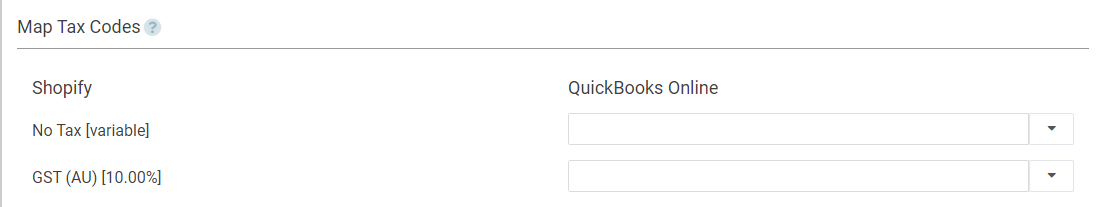

Here's a screenshot sample of tax mapping settings for Shopify and QuickBooks Online integration:

All you'll need to do here is let us know what tax from your QuickBooks Online matches the tax we found in your eCommerce system. Once the setup is to you and your bookkeeper's liking, go ahead and finish the integration setup.

QuickBooks and Automatic Taxes (USA only)

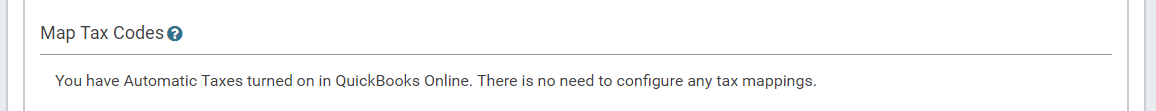

Certain QuickBooks Online accounts have the ability to calculate taxes automatically based on the order shipping address.

Please make sure to read this guide from QuickBooks Online (US-Only) to ensure that you have this feature enabled.

In this scenario, there is no need for you to configure tax mappings. QuickBooks will do this for you!

Comments

0 comments

Please sign in to leave a comment.